Read our letter to the House of Representatives’ Ways and Means Committee and Energy and Commerce Committee in support of capping Part D costs.

The MAPRx Coalition (MAPRx) urges Congress to establish a cap on out-of-pocket costs in Medicare Part D to limit the amount Medicare beneficiaries have to pay for covered prescription drugs. More than 44 million Americans depend on Medicare Part D for their drug coverage. A cap on out-of-pocket costs will help ensure Medicare beneficiaries have access to vital and life-saving medicines.

Since it was implemented in 2006, Part D has been viewed as a success story due to its overall popularity among enrollees and lower-than-expected government expenditures. Despite its overall strength, current challenges remain around access to medications, the availability of key information about plan coverage and costs, and beneficiaries’ ability to pay out-of-pocket (OOP) costs associated with covered medications. These issues loom large over the future of the program.

Presently, the lack of an out-of-pocket cap is one of the biggest challenges inhibiting the program from being an even more successful resource for the healthcare needs of the country’s Medicare beneficiaries – seniors and those living with serious and chronic conditions.

The standard benefit design in Part D includes some features that are similar to commercial plans such as: a deductible phase during which beneficiaries are responsible for 100% of costs and an initial coverage period when beneficiaries pay 25% of costs. Beneficiaries then enter what is commonly referred to as the donut hole or coverage gap. However, beginning in 2019, beneficiaries will continue to pay 25% of costs until they spend a total of $5,100 in out of pocket cost at which point they reach the OOP threshold and enter catastrophic coverage and are responsible for 5% of costs.

While the Part D benefit offers an OOP threshold, there is no true cap on OOP expenditures in Part D. This benefit design feature contrasts with most commercial plans which have a single out-of-pocket cap for all covered services. It also is unlike Medicare Part B, where beneficiaries have other OOP protections (such as the ability to purchase supplemental coverage). Supplemental coverage and OOP caps enable beneficiaries to better anticipate their health care costs and meet their financial obligations.

The lack of an OOP cap in Part D is particularly challenging for beneficiaries because of the proliferation of specialty tiers. Drugs placed on specialty tiers are subject to significant coinsurance and beneficiaries do not have an option to receive a cost-sharing exception. This forces beneficiaries to pay a significant percentage of a medication’s cost. For drugs covered on the specialty tiers, the coinsurance amounts can range anywhere from 25% to 33%, leaving beneficiaries paying thousands of dollars in OOP costs for drugs and biologics used to treat cancer, multiple sclerosis, rheumatoid arthritis, and other conditions. As a result, many beneficiaries are denied access to the most clinically appropriate medication simply because there is no OOP cap to limit their financial liability.

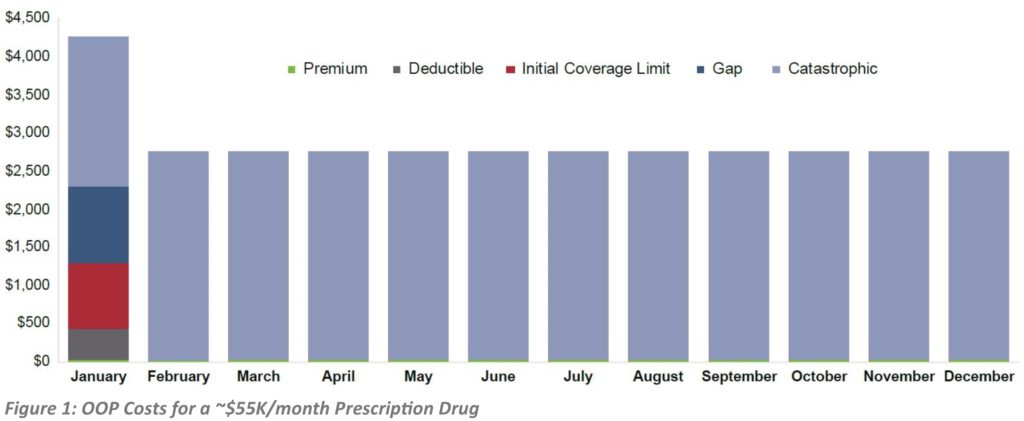

While the current 5% coinsurance during catastrophic coverage may seem reasonable, for many beneficiaries it can mean thousands or tens of thousands of dollars in additional costs for the rest of the calendar year, until the cycle starts anew. For example, a product that costs over $50,000 per fill could result in OOP expenses of almost $35,000 annually. Assuming a beneficiary starts therapy at the beginning of the plan year in January and has a standard benefit design, they may pay over $4,000 for the first month, effectively moving to catastrophic coverage. For the rest of the year, the patient may still pay $2,700 monthly just for this 1 treatment.

MONTHLY CAP AN IMPORTANT CONSIDERATION

Because OOP costs are greater during the deductible and initial coverage phases, many beneficiaries reach catastrophic coverage early in the calendar year and therefore face significant costs in just a single month even if there is an annual OOP cap (see Figure 1). Therefore, MAPRx believes that as Congress considers an annual OOP cap, they also should examine ways in which beneficiary costs could be spread out throughout the year through a monthly OOP cap or other mechanism.

HIGH OUT-OF-POCKET COSTS IMPACT DRUG UTILIZATION

A number of analyses, including ones issued by the Medicare Payment Advisory Commission (MedPAC), have shown that high OOP costs have significant negative consequences that not only can lead to increased costs across the health care system, but also worse outcomes for beneficiaries.

High OOP costs under Part D are associated with reduced adherence to medication, reductions and delays in accessing treatments, interruptions in treatment, and discontinuation of treatment altogether.

These impacts are not isolated to any particular disease or treatment, but are consistent regardless of the type of disease and are attributable at least in part to the lack of an OOP cap.

AMERICANS SUPPORT AN OUT-OF-POCKET CAP

A February 2019 Kaiser Family Foundation Health Tracking Poll found that 76 percent of Americans support placing a cap on what beneficiaries pay OOP each year for prescription drugs in Medicare Part D.

As more Americans become eligible for Medicare, the Part D program will play an increasingly integral role in maintaining beneficiaries’ health and reducing overall health care costs. MAPRx Coalition stands ready to work with Congress to add a Part D OOP cap to build a Medicare Part D for the future.

For additional information, please contact:

Bonnie Duffy

Convener, MAPRx Coalition

info@maprx.info

202-540-1070